%Fee program

The goal of adding a fee program is to provide a convenient and secure payment option for customers while also covering the costs associated with processing these transactions.

Cash Discount

Is a reduction in price offered to customers who pay in cash or by a specific payment method (e.g., credit card).

- The discount is usually a percentage of the original price and is offered as an incentive to encourage customers to use a preferred payment method.

- Cash discounts aim to reduce transaction costs, speed up payment, and increase customer loyalty. This option is accepted in ALL states, applies a surcharge fee up to 4% on BOTH Debit/ Credit transactions by NOT showing an item line on customer receipt. Typically disclosed to the customer before the transaction is completed.

- Cash discounts aim to reduce transaction costs, speed up payment, and increase customer loyalty. This option is accepted in ALL states, applies a surcharge fee up to 4% on BOTH Debit/ Credit transactions by NOT showing an item line on customer receipt. Typically disclosed to the customer before the transaction is completed.

Dual Pricing

Involves setting two different prices for the same product or service, depending on the customer’s location, market conditions, or other factors.

- One price is usually higher, targeting customers who are willing to pay more (e.g., in a tourist area), while the other price is lower, targeting price-sensitive customers (e.g., locals).

- Dual pricing aims to maximize revenue by capturing different customer segments’ willingness to pay. This option is accepted in ALL states, applies a surcharge fee up to 4% on BOTH Debit/ Credit transactions by NOT showing an item line on customer receipt.

Key differences

- Purpose: Dual pricing targets different customer segments, while cash discount targets payment methods.

- Structure: Dual pricing has two separate prices, while cash discount is a percentage reduction from the original price.

In summary, dual pricing and cash discount are distinct pricing strategies with different goals, structures, and applications.

Key differences

- Purpose: Dual pricing targets different customer segments, while cash discount targets payment methods.

- Structure: Dual pricing has two separate prices, while cash discount is a percentage reduction from the original price.

In summary, dual pricing and cash discount are distinct pricing strategies with different goals, structures, and applications.

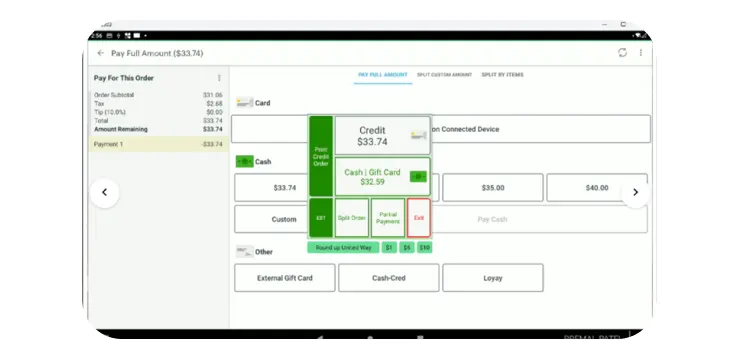

Surcharge

Program is a pricing strategy where a merchant adds a fee to a customer’s bill for using a specific payment method, usually credit cards. This fee is typically a percentage of the transaction amount, and its purpose is to offset the costs associated with processing credit card transactions, such as interchange fees and processing charges. This option is only accepted in certain states, applies a surcharge fee up to 3% and you ONLY surcharge on Credit transactions by showing an item line on customer receipt. Typically disclosed to the customer before the transaction is completed.

Here are some key aspects of a Surcharge Fee Program:

- Fees

A percentage (usually 1-3%) added to the transaction amount for using a credit card.

- Disclosure

Merchants must clearly disclose the surcharge fee to customers before the transaction.

- Credit Card Specific

Surcharge fees typically apply only to credit card transactions, not debit cards or other payment methods.

- Variable Fees

Fees can vary depending on the type of credit card used (e.g., premium cards may incur higher fees).

- Regulatory Compliance

Surcharge Fee Programs must comply with relevant laws, regulations, and card network rules (e.g., Visa, Mastercard).

- Customer Choice

Customers may choose to use an alternative payment method to avoid the surcharge fee.

- Variable Fees

Fees can vary depending on the type of credit card used (e.g., premium cards may incur higher fees).

- Regulatory Compliance

Surcharge Fee Programs must comply with relevant laws, regulations, and card network rules (e.g., Visa, Mastercard).

- Customer Choice

Customers may choose to use an alternative payment method to avoid the surcharge fee.

Convenience Fee

Program is a system that allows businesses or organizations to charge an additional fee for providing convenient payment options to their customers or clients. This fee is typically a small percentage of the transaction amount and is meant to offset the costs associated with processing payments through credit cards, online systems, or other convenient methods. This option is accepted in ALL states, applies a surcharge fee up to 4% on BOTH Debit/ Credit transactions by showing an item line on customer receipt. Typically disclosed to the customer before the transaction is completed.

Convenience fee programs are commonly used in various industries, including:

- Education (e.g., paying tuition or fees online)

2. Government (e.g., paying taxes or utility bills online)

3. Healthcare (e.g., paying medical bills online)

4. Event Ticketing (e.g., buying tickets online)

5. Online Shopping (e.g., paying for products or services online)